Jones Act

Settlement Loans

Jones Act or Maritime Lawsuit pre-settlement legal funding may be the solution you need if you’re struggling to pay the bills because of the injuries you sustained while working on a sea-going vessel.

We provide NO RISK, FIXED FEE, ZERO RECURRING INTEREST lawsuit loans from $250 and up.

Jones Act Maritime Injury Loans That Are No Risk, Fixed Fee And Zero Recurring Interest

Traditional workers’ compensation insurance doesn’t cover employees who work on a ship, barge, or oil rig. However, the Jones Act is a federal statute that allows for maritime employees or seamen to recover compensation for personal injury damages. Although you can (and should) file a Jones Act claim if you’ve been injured while at sea, you’ll have to wait a while to get that compensation into your pocket. Like all lawsuits, a Jones Act claim won’t undergo a swift process.

Your seaman injury case will likely settle out of court, in which case you won’t have to go to trial. Avoiding a trial will help speed up the completion of your mariner lawsuit or seaman injury case. But settlement negotiations can take an equally long time to finish. Also, once the negotiations are complete, there’s no guarantee when you’ll get your settlement check.

If you’ve been injured on the job while working on a sea-going vessel and you’re pursuing a seaman case through the Jones Act, you don’t have to wait until your case settles to get paid. You can apply for pre-settlement funding and obtain a portion of your expected settlement to put in your pocket immediately. Pre-settlement funding will carry you financially until you get your settlement money.

Do your injuries prevent you from performing your usual job on a large boat or vessel? If you’re unable to work and your bills are piling up, pre-settlement funding will keep you afloat until your case settles and your check is in hand. While you’re waiting for your settlement money, you’ll need to have enough cash on hand to be financially self-sufficient without a steady source of income. That’s not acceptable when your savings account is drained, the bills are piling up, and you need money for food, fuel, and lodging

You can’t afford to wait months for a settlement check; you need money now. Apply today for settlement funding from Capital Now Funding or call us at 1-855-CAP-FUND right now. Pre-settlement funding comes with ZERO RISK: If you don’t win your case, you don’t have to pay it back.

LET US PROVE WE ARE THE BEST PRE-SETTLEMENT FUNDING COMPANY!

Capital Now Funding versus competitors

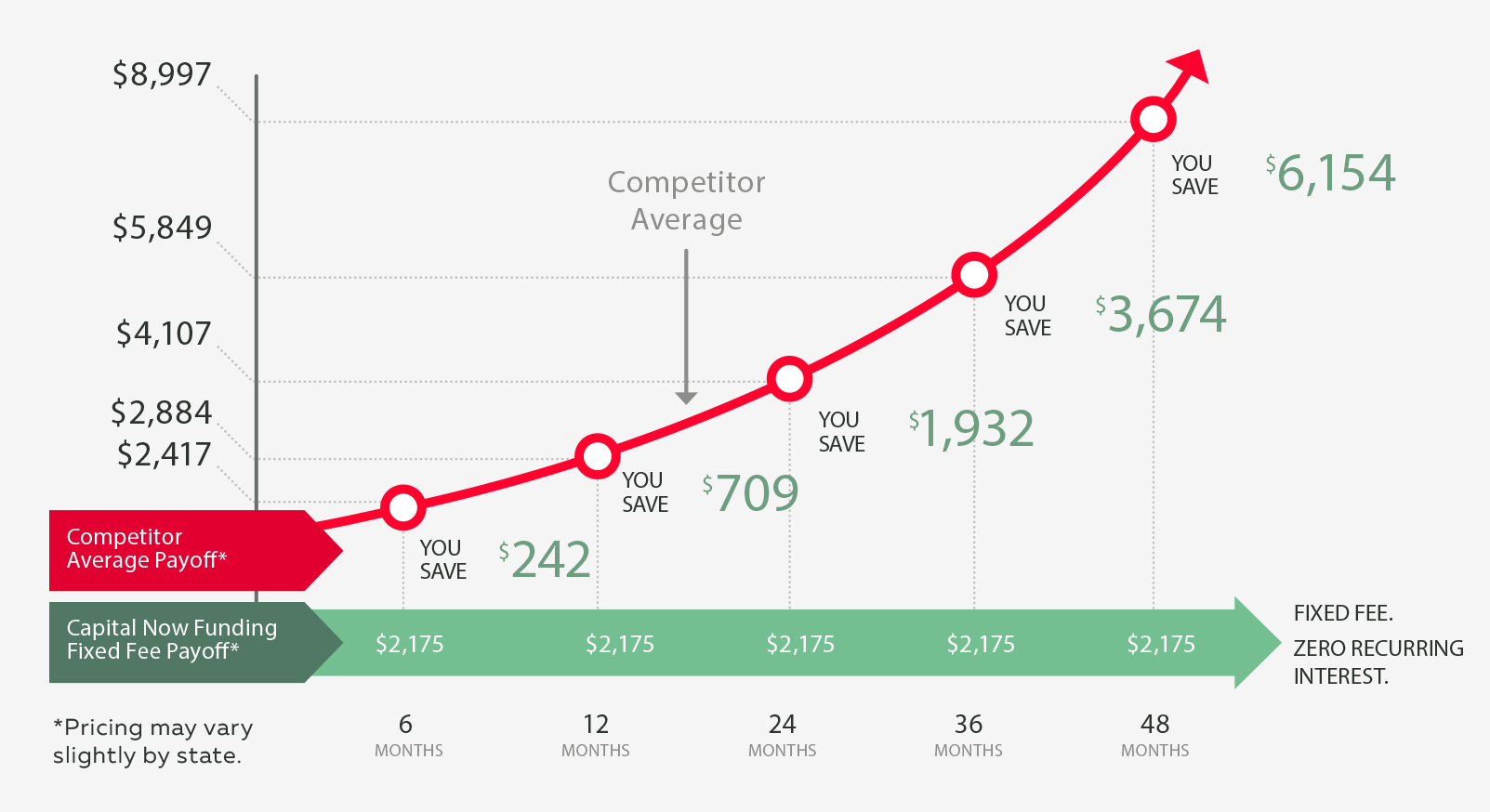

We are the only pre-settlement funding company that provides lawsuit settlement loans for a FIXED FEE with ZERO RECURRING INTEREST. When your case closes, there is no need to haggle over excessive fees or constantly changing payoffs.

With Capital Now Funding, you get the peace of mind knowing that your payoff is fixed for the life of the case!

WHAT IS A JONES ACT – MARITIME LAWSUIT PRE-SETTLEMENT LAWSUIT LOAN?

It’s not actually a lawsuit loan – because loans are something that you must repay. Capital Now Funding is not offering a lawsuit loan, but rather a non-recourse assignment and purchase of an asset; that being a portion of the proceeds of your legal claim. Essentially it is an advance against your future lawsuit settlement. In other words, if you lose your settlement, you owe us nothing. There’s no risk.

HERE’S

How it works

1. You

Apply

Use our quick online form to apply in minutes or call us at 1-855-CAP-FUND for our NO RISK, FIXED FEE pre-settlement lawsuit loan that never increases, regardless of the length of the lawsuit.

2. WE

Approve

Our team reviews the lawsuit details with you and your attorney and can approve in as little as 24 hours. Your credit score is not a factor.

We can text or email the contract to you for easy online electronic signature, and the contract is automatically sent back to us. No third-party apps need to be downloaded or accounts created.

3. RECEIVE

Funds

Upon application approval, you receive your funds within 24 hours and your money is available immediately.

FUNDING METHOD OPTIONS

ACH / Direct Deposit

Same Day Wire (additional fee applies)

Standard Check

Digital Check Emailed

4. NO RISK. FIXED FEE.

ZERO RECURRING INTEREST.

With most other Jones Act pre-settlement loan companies, the longer your case takes to settle, the more money you have to pay back due to rising interest rates, but not with CAPITAL NOW FUNDING.

Our FIXED FEE funding with ZERO RECURRING INTEREST means your payoff never increases – no matter how long it takes to settle your Jones Act lawsuit. And because our funding is non-recourse, if you lose your case, you owe us nothing.

ELECTRONIC

FUNDING IN

24 HOURS

THINK A JONES ACT PRE-SETTLEMENT LAWSUIT LOAN IS RIGHT FOR YOU?

The legal process takes time, meanwhile you have bills to pay and a life to live. We understand. That’s why CAPITAL NOW FUNDING is here – to help you bridge the gap and provide the money you need NOW before your Jones Act lawsuit settles.

And when we say no risk, we mean it. If you lose your Jones Act lawsuit, you owe us nothing. If you win, your attorney will send us your fixed payoff amount out of your settlement. Plus, your lawsuit loan payoff amount is fixed and will never increase – no matter how long it takes to settle your case.

With Capital Now Funding, lawsuit loans are simplified. There is NO RISK, we charge a FIXED FEE, and we NEVER charge recurring interest. Get the lawsuit settlement loan advance you need NOW from CAPITAL NOW FUNDING.

HOW DO I GET PRE-SETTLEMENT LEGAL FUNDING WHILE MY JONES ACT SETTLEMENT IS PENDING?

NO RISK. FIXED FEE. ZERO RECURRING INTEREST. That’s the bottom line. And it’s the best bottom line for you.

Fortunately, while your Jones Act or maritime injury lawsuit is pending, injured plaintiffs can look to Capital Now Funding for the funds that provide immediate relief.

Pre-settlement legal funding from Capital Now Funding helps accident victims bridge the gap with financial assistance that is needed before their Jones Act case is settled. You may be injured and unable to work. It can help you pay your bills while you are waiting for your case to settle. This way, you can live now and get immediate help with the bills you are facing now – such as rent, utility bills, car payments, living expenses, medical bills, and more.

There are many different kinds of Jones Act accidents, but they all can be a huge burden for victims and their families, with unfortunate outcomes such as physical, financial, and mental anguish. Jones Act or seaman accidents that cause serious injuries are often life changing. And being able to pay your bills so you can afford to wait patiently for your lawsuit to settle properly is important. So, obtaining pre-settlement funding is a great option.

And Capital Now Funding is your best option for Jones Act pre-settlement funding. With most other pre-settlement legal funding companies, the longer your lawsuit takes to settle, the more money you have to pay back due to rising interest rates, but not with Capital Now Funding. Our FIXED FEE funding with ZERO RECURRING INTEREST means your payoff never increases – no matter how long it takes to settle your Jones Act case. And because our funding is non-recourse, if you lose your case, you owe us nothing – that’s NO RISK.

Related Cases We Fund

We provide pre-settlement funding for a wide range of motor vehicle and personal injury accident cases, including:

Get no risk, fixed fee, zero recurring interest Jones Act legal funding in 24 hours

With most other Jones Act pre-settlement legal funding companies, the longer your case takes to settle, the more money you have to pay back due to rising interest rates, but not with CAPITAL NOW FUNDING.

Our FIXED FEE funding with ZERO RECURRING INTEREST means your payoff never increases – no matter how long it takes to settle your Jones Act case. And because our funding is non-recourse, if you lose your Jones Act case, you owe us nothing. If you have questions but aren’t yet ready to apply online, just call us anytime at 1-855-CAP-FUND or complete our Contact Us form with your questions. Our staff will walk you through the process and answer any questions you have.

ELECTRONIC FUNDING

IN 24 HOURS

Jones act – maritime lawsuit legal funding FAQs

You can qualify for a Jones Act pre-settlement lawsuit loan if you have a Jones Act claim and hired an attorney to take your case. Most kinds of Jones Act lawsuits are covered by pre-settlement legal funding. In fact, Capital Now Funding provides funding for a variety of different types of cases including: car accidents, semi-truck/big rig truck accidents, car wrecks, truck wrecks, hit and run accidents, drunk driver accidents, workers’ compensation accidents, Jones Act (maritime or seaman lawsuits), medical malpractice lawsuits, wrongful death lawsuits, nursing home abuse lawsuits, slip and fall accident, ridesharing – Lyft & Uber accidents, bus accidents, motorcycle accidents, electric scooter accidents, and even bike accidents. . The injuries that are covered are wide ranging, including fractures, head injuries, spinal injuries, brain injuries, and many others.

After you’re approved, sign and return your agreement to us, you will receive your funds in about 24 hours. The timing can sometimes depend upon how long it takes for your attorney to review, sign and return the agreement (if required) back to us.

We also have multiple funding method options available to you in order to provide your funding as soon as possible. The funding method options include:

- ACH / Direct Deposit – receive funds by 9:00 AM the next day

- Same Day Wire (additional fee applies)

- Standard Check – sent by regular USPS mail or overnight (additional fee applies for overnight shipping)

- Digital Check Emailed

We ask for the amount of funding you think you will need when you submit your application. We will then contact your attorney to learn more about your Jones Act lawsuit to determine the amount of Jones Act pre-settlement funds that your case justifies. Our pre-settlement lawsuit loans can range from as little as $250 and up depending upon the size of your pending lawsuit settlement. If you have any questions about your approved Jones Act funding amount, we can answer them when you review your approved Agreement or you can Contact us.

It is not a loan at all. It actually is a cash advance made to the plaintiff against the estimated settlement to be received from the Jones Act lawsuit when it settles. The amount of cash that is advanced to the plaintiff will be subtracted from the amount of money gained at the settlement of the case. If the case is not successfully settled, the cash advance does not have to be paid back, because it is non-recourse funding. Non-recourse funding is simply a legal term that means you owe nothing if your case is not successful. It is not a legal loan that has to be paid back.

Yes, but we make it easy for both you and your attorney. When you apply for funding, we will contact your attorney to learn more about your pending lawsuit and review the information both to approve your application for pre-settlement funding and also for the amount of pre-settlement funds that your Jones Act lawsuit justifies.

Then, if your state law requires both your signature and your attorney’s, you will both sign the funding agreement. Our team consults with your attorney with one quick 5 minute phone call or email to review the case details. Upon funding approval, we text or email the contract to you for easy online electronic signature, and the contract is automatically sent back to us. No third-party apps need to be downloaded or accounts created. If a state requires Attorney Acknowledgment, we use the exact same electronic process you get your attorney's signature. This ensures that you are receiving your Jones Act pre-settlement lawsuit loan without any unnecessary risk. Some states do not require your attorney’s signature on the funding agreement, only yours.

There are no specific requirements for how you can use the Jones Act pre-settlement funds. Most people use the funds to cover essential expenses involved in a personal injury case, such as medical bills, living expenses, rent, car payments, and bills that absolutely must be paid during the time before their settlement is made. Since victims of an accident may be unable to work, being able to use this money at your discretion can be a big relief and bridge the financial gap you need to pay bills until your Jones Act lawsuit is settled.

Depending on the difficulty of your case, many Jones Act injury lawsuits can take a long time until a settlement is reached. If that happens, it is good to know that with Capital Now Funding, our pre-settlement loans are for a FIXED FEE and ZERO INTEREST which means that the amount you owe at settlement will never increase – no matter how long it takes to settle your lawsuit. Our fee does not increase over time, unlike most other funding sources whose interest rates keep going up the longer it takes for your lawsuit to settle.

No, a credit check is not needed and getting a pre-settlement Jones Act loan will not hurt or even affect your credit score. And since you will not have to pay back the pre-settlement loan if you lose your lawsuit, there is no risk to you.

Many people do not realize that personal injury lawsuit cases can last months or in some cases even years, which can place a very difficult financial strain on plaintiffs waiting for a settlement.

Receiving a Jones Act pre-settlement loan can help you wait longer, which allows your attorney the time needed to negotiate the best settlement for you. The ability to be patient and wait longer takes leverage away from the insurance companies who like to pressure plaintiffs to settle quickly for less money than they deserve. This way, getting a Jones Act pre-settlement lawsuit loan actually can give you and your case a real advantage. Our FIXED FEE funding with ZERO INTEREST means your payoff never increases – no matter how long it takes to settle your lawsuit.

- You’re injured and can’t work – You should consider a Jones Act pre-settlement lawsuit loan if you were involved in a Jones Act and have a pending case or lawsuit in process. If your injuries or claims are serious and you can’t work and you need help paying your bills while you are waiting for your lawsuit to settle, then applying for a Jones Act pre-settlement lawsuit loan from Capital Now Funding is a good option. There is no risk associated with Capital Now Funding as you only have to pay back the funds you receive if you win your settlement. Lawsuits can take a long time to settle, and the bills that pile up in the interim will not wait for a Jones Act to settle. That’s why pre-settlement legal loans can help you pay the essentials, including medical bills, food, rent, gas, and other basic and fundamental necessities while you are waiting for your attorney to settle your case in the best possible manner.

- Insurance companies are making you low offers – Regardless of your situation, the insurance companies want to pay you as little as possible. The more patient you can afford to be in settling your Jones Act lawsuit, the more likely the adjuster will be convinced that you and your attorney won’t settle for a low amount. The longer you are willing to fight, the bigger are the settlement numbers that will be offered by the insurance company adjuster. By gaining a jones act – maritime lawsuit pre-settlement loan advance from Capital Now Funding, you give yourself and your attorney the time needed to properly fight for the higher level of money you deserve.

- You need immediate funding that is Risk Free with a FIXED FEE and ZERO INTEREST – Unlike other ways to get financial support while you’re waiting on a pending settlement, getting Jones Act pre-settlement legal funding is simple. Your credit score is not affected. The only factors needed for approval are the facts of your pending lawsuit. Best of all, a Jones Act pre-settlement lawsuit loan from Capital Now Funding is completely risk-free, with a FIXED FEE and ZERO INTEREST. And because it is non-recourse funding, you only pay the money back if you win the case. And since the interest never increases no matter how long your settlement takes, you and your attorney have the time you need to get the best settlement with the insurance companies.